| 主页 » VIP » 市场 » 看盘 |

本周前瞻:A股剧烈波动,房地产股大幅反弹

| 2015-02-01, 10:22 AM | |

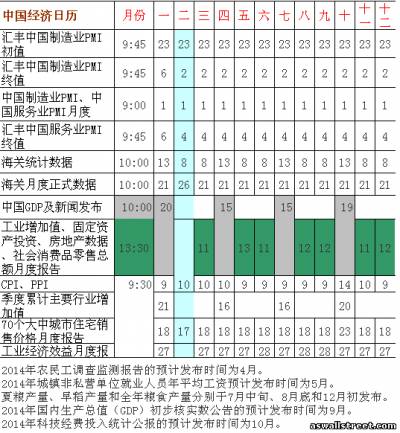

| 上周回顾: There was a sense of wariness in global markets this week as participants moved beyond ECB easing to mull over the Greek government turnover, some upsetting corporate quarterly reports, and the Fed's steady course toward rate hikes. Syriza's victory in Greece was widely expected, and focus is now on how Athens and the Eurozone can work out a new deal that allows both sides to save face. The FOMC decision on Wednesday strongly suggested that the Fed is on track for rate liftoff later this year after upgrading its growth assessment to "solid" from "moderate", though it did acknowledge that "international developments" are being watched closely. Meanwhile, corporate giants like Microsoft, Caterpillar, and ConocoPhillips saw losses as they grappled with the strong dollar and weak oil prices. The US 10-year yield fell to new 2015 lows below 1.70%, levels not seen since 2012. The first look at US fourth quarter GDP was good, not great (+2.6% versus final Q3 +5.0%), although consumption remained strong. US durable goods orders were not pretty, while in China, December industrial production contracted 8%, twice the November decline. The Shanghai Composite lost ground on the week for the first time in nearly three months, while the DJIA fell 2.8%, the S&P500 declined 2.8% and the Nasdaq lost 2.6%. 希腊大选导致欧元区震荡,新政府与三驾马车的新谈判备受关注。美国公司季报差强人意,美国GDP中性偏弱,美联储观望稍微偏向鹰派继续支撑美元,美债继续攀升。中国经济继续大幅下滑,上证指数下跌,美股下跌。 In Greece, the anti-bailout Syriza swept into power in elections last Sunday with an overwhelming 10-point lead over the ruling New Democracy party. Syriza took 149 seats, just shy of the 151 required for an outright majority, requiring it to recruit the right-wing, anti-bailout Independent Greeks party (with 13 seats) as coalition partner. Syriza's mercurial leader Alexis Tsipras said the election marks the end of bailout agreement for Greece and cancels austerity. The new government immediately began preparing to cancel certain privatization deals and met with EU Commissioner Dijsselbloem to discuss a new deal with Europe. The euro sank on the news, with EUR/USD touching 1.1100, although it rebounded toward the 1.13 handle later in the week. Central bank calibration continued this week. The Singapore Central Bank (MAS) joined the currency wars with an intermeeting policy easing on Thursday. In the first unscheduled announcement in 13 years, the MAS cut its 2015 headline CPI forecasts while also lowering the slope of SGD policy band, sending the currency to its weakest levels since 2010. The Reserve Bank of New Zealand adopted a more cautious stance, tightening bias and also introduced the possibility of a rate cut as its next policy move. In Europe, the Danish Central Bank cut its CD rate for the third time in two weeks, to -0.50% from -0.35%, as the Danes struggle to maintain the EUR/DKK peg. Analysts say the DKK trading band could be widened soon if the pressure on the euro continues. Finally, the Russian Central bank took its one-week auction rate down to 15% from 17%, in what analysts called a highly political decision. On Monday, OPEC Secretary General El-Badri tried to call a bottom in oil and insisted that prices would begin rising soon, with $200/bbl prices possible in three or four years if new oil investment really started falling. El-Badri insisted that Saudi policy under the new king would remain the same. The oil industry seemed to heed El-Badri's words as a number of the major E&P firms announced sharp y/y reductions in 2015 capex in their earnings reports. The closely watched Baker Hughes rig count registered another steep decline. The US rig count dropped 5.5% on the week, and that combined with a report of ISIS launching a fresh attack in Kurdish territory sent crude futures higher into the close on Friday. After grinding lower for most of the week, WTI crude futures rang up an 8% gain into the close on Friday, topping $48/bbl. Oil majors detailed the impact from the decline in crude over final quarter of 2014 in quarterly reports. Shell, Total, Conoco and Chevron all announced double-digit percentage cuts to their 2015 capex plans versus 2014 (the standouts were Conoco cutting about 20% and Total cutting by 30%). Independent E&P firms Hess and Occidental Petroleum also cut capex levels (Occidental cut by 33%). The majors saw their upstream earnings plummet, while downstream earnings are barely helping them keep up. Shares of CVX, COP and XOM fell 4-5% on the week, while HES was off 8%. Meanwhile refiners Valero and Phillips 66 saw solid gains in profit from lower crude costs, and modest share gains this week. Solid earnings reports from DR Horton and Pulte Homes helped drive gains for the major US homebuilders. Housing data out this week wasn't stellar: pending home sales dropped more than expected in December, however the month's total was still higher than the year-ago figure. Meanwhile the November S&P/Case Shiller index gained 4.3% y/y, the slowest in two years, indicating that lean inventories and tight lending standards have limited housing activities. Both Pultle and DR Horton said they were looking forward to a strong spring selling season. Apple set a record for the most profits in a quarter ever reported by a public company with its first quarter results. iPhone shipments hit a new record high, at 74.5 million units as Apple's new large format phones were a hit, especially in China. Revenue absolutely crushed expectations on the strong sales of the high margin iPhone 6 and 6 plus. Investors did not react well to Microsoft's results, as net income contracted due to price cuts among its Windows and Xbox businesses. Facebook saw healthy y/y gains in both EPS and revenue, while mobile users were up 34% y/y. Alibaba's shares peaked in early November and have been on the wane since, and this week's fourth-quarter report sent shares down close to 10% after revenue missed estimates. Some analysts cut the name, warning about revenue growth, while others doubled down on optimistic buy ratings. Meanwhile Yahoo disclosed its plan to spin off all of its Alibaba holdings to its shareholders, seen as a positive development, but the swoon in BABA shares dragged YHOO down right along with it. Yahoo's flat fourth-quarter search revenue and sinking display revenue did not help. Amazon had a very good holiday quarter, reporting margins back in the black and earnings way ahead of expectations. Shares of AMZN rose more than 10% after its report. 阿里巴巴股价下跌10%。 Dollar strength is becoming a big headache for US corporations with significant overseas revenue, including consumer and drug companies. Both Lilly and Pfizer turned in decent fourth-quarter results, and both cited big FX impacts for some less-than-impressive full-year guidance. Colgate-Palmolive and Proctor & Gamble both missed revenue targets and warned FX was becoming a problem. P&G said FX would reduce 2015 sales by 5% and net earnings by 12%, while Colgate said FX cut 9% off revenue in its fourth quarter. China reported more troubling data this week. December industrial profits declined twice the amount seen in November, -8% versus -4.2% m/m, and 2014 industrial profit growth was just 3.3%. Officials acknowledged the downward pressure on the economy, but also said this is the "new normal." The PBoC injected liquidity for a second week in a row, again citing the anticipated cash squeeze going into the Lunar New Year holiday. Lower oil prices showed up in Japan's CPI data. December core nationwide CPI and January Tokyo CPI declined to 9- and 10-month lows, respectively. Meanwhile, Japan is approaching the consumption tax hike roll-off in April, which could send annual CPI levels back to negative territory and leave Abenomics even further from its key objective of 2% inflation. Other December datapoints were similarly troubling: household consumption fell y/y for the ninth straight month and industrial output missed consensus, although exports stayed strong, rising 12.9% y/y. None of this stopped the cabinet from maintaining its economic assessment of "gradually recovering" for the fourth consecutive month. USD/JPY bounced around in a range between 117.40 and 118.60. 本周点评: 1、因全球油价下跌损害公共财政收入,墨西哥政府周五(1月30日)宣布了一系列紧缩措施,将2015年预算削减近3%,并搁置了墨西哥城至克雷塔罗高铁项目的新一轮招标。 这会影响中国高铁股票短期下跌。 2、据《财经》多方证实,此次被纪检部门带走协助调查的就是民生银行行长毛晓峰,多位民生银行高层亦证实:近日确实已经联系不上毛行长,其手机处于关闭状态。但相关高层拒绝证实毛是否被带走协助调查。然而,这场突然来袭的重大变动,将会使正在经历重大股权变动的民生银行,再度遭遇变数。数据显示,自去年下半年以来,安邦保险集团已经在二级市场累计买入民生银行股份超过20%。安邦保险集团正在加速渗透,未来必将谋求更多的董事会席位。新一轮民生银行控制权之争一触即发。与此同时,市场还有传言称,民生银行前董事长、现任中民投董事会主席董文标亦被限制离境。不过,1月30日上午董文标参加了中民投全球专家咨询委委员会议,董神情轻松、并无异常,他对《财经》说:“安邦入驻民生银行,对银行未来的发展是好事。” 短期会对银行股导致重大下跌压力,民生银行是沪深300前10名权重股,势必导致中国股指期货大幅下跌。但也有可能股市低开走高,对新行长充满期待。 3、中国统计局周日(2月1日)公布的数据显示,中国1月官方制造业PMI 49.8% 为两年多以来首次跌破50% ,创19个月低点。这反映出中国制造业活动动力仍显不足,市场对于进一步经济刺激措施的预期或将升温。统计局PMI继续回落的原因,一是受元旦春节及季节性因素影响。近6年除2012年外,其他年1月的PMI环比均为回落;二是大宗商品价格持续下跌,1月主要原材料购进价格指数41.9%,近6个月逐月回落;三是国内外市场需求总体继续偏弱 制造业依然没有见底,不过下跌缓慢,未来加速下跌的可能不大,因中国政府开支新一轮的大规模基建以替代房地产业的景气下跌。股市近期的反弹依然缺乏基本面上的支持。这对中国股市造成较大的负面影响。周一汇丰将公布中国制造业PMI,本数据可能较官方数据更为可信,预计数据反而稍微转好,上期数据止跌回升,本期下跌的可能不大。 4、“一号文件”公布在即。“一号文件”历来以支持农业为主,历史上农林牧渔板块在2月份也经常取得高于大盘的相对收益。这次“一号文件”可能强调的农村生产要素释放及其延伸影响值得关注。 “一号文件”是2月份季节性的主题概念,今年也不仅仅是简单的主题概念。 5、2014年12月,全国工商联环境商会秘书长骆建华透露,水十条已通过国务院相关部门的认证。他继而指出,未来环保的重点领域包括大气、水和土壤三块。短期内,本届政府在大气、水和土壤防治上的投资需求大概是6万亿元,但6万亿的投资需求只是短期目标,还不能根本解决问题。另外,《大气污染防治法》(修订草案送审稿)也已经向国务院报送;《排污许可管理条例》(征求意见稿)也已形成,现在征求环保系统意见;《核安全法》、土壤污染防治法等相关文件也正在加快制定中。 6、1月30日晚间,证监会核发新一批IPO批文,含东兴证券、唐德影视等24家,超过上一批20家。业内人士认为,该消息对A股市场构成利空影响。 7、作为2015楼市开年首月,房地产市场走势及房价变动情况备受关注。据中国指数研究院最新发布的百城房价指数显示,1月份全国100个城市(新建)住宅平均价格为10564元/平方米,环比在经历连续8个月下跌后,本月止跌,微涨0.21%。具体来看,十大城市中6个城市环比上涨,较上月增加1个,依次为北京、上海、重庆(主城区)、深圳、杭州、广州。其中,北京住宅均价环比上涨1.15%,涨幅居十大城市首位。 预计房地产可能反弹3-6个月,暂时持稳,但中长期依然下跌趋势。 综合评论: 周末消息很热闹:中国制造业PMI跌破50,民生银行行长被带走,墨西哥无限期推迟高铁项目招标,这些对股市来说都不是好消息。24只新股发行,A股中性。北京房地产政策放松,非京籍购房须连缴5年以上社保对住房公积金缴存年限并无要求,房地产限购可能也会逐步取消。房价止跌反弹。 全球股市下跌、原油大幅反弹。A股板块关注地产、石油等资源、二线蓝筹,题材看好国企改革、一带一路等,注意金融地产走势。今日大幅低开上行,关注3230点大关。中期预计冲击3500点,长期牛市。今日关注中国石油。 近期关注关键事件: 近期出台:《水污染防治行动计划》《大气污染防治法》《排污许可管理条例》《核安全法》;中国政府公务员、国营企业工资上调利多消费类股票。 2月中央一号文件发布:继续关注农业现代化;2月18日春节前后降准,A股重大利好。 3月4日两会召开,之前A股上升几率较大;3月欧洲央行继续量化宽松,利好欧股。3月中国不动产登记出台,重大利空房地产股。 4月中国民营银行开业,之前利好民营银行股。 6-7月美联储可能加息,重大利空美股,影响全球金融市场。 9月2日:中国有史以来最大阅兵式,重大利多军工股。 未来数据一览:

| |

| 评论数:: 0 | |